A second home purchase is largely a lifestyle decision, based on one's confidence in a career, in personal income, net worth, as well as perceived use. As such, the growth in the industry has been one defined by a general rise in disposable income and by demographic shifts, regardless of buyer source or location. The post WWII emergence of a strong middle class, rising automobile ownership and use providing reasonable access to recreation locations, and the 'age wave' of the Baby Boomer precipitated an increase in the incidence of second home ownership starting in the early 1970's, reaching a crescendo in the 2005 to 2009-time frame.

Evolution of Second Home Ownership

Interest in ownership has also varied over time. The original emphasis was on personal use within reasonable access time, which tended to mitigate the consumer's willingness to commit large amounts of their financial resources. The result was relatively modest developments occupied seasonally. Starting in the late 1970’s and early 1980's, as the Baby Boomers plunged into the market, price escalation in second home locations began to outpace the rise in primary housing values in many markets, resulting in a shift to a user/investor profile, wherein a second home purchase increasingly became justified less on the perceived usage pattern than as a pure alternative investment. This trend also came to peak with the easy money and lending standards that emerged during the early 2000's.

The net result was an artificial escalation of both price and demand that came to a resounding end between 2005 and 2009. In recessions since 1980, when the growth of the second home market began to accelerate, the duration of the events were relatively short (less than a year) and the impact on GDP relatively modest. The most recent recession lasted longer and the impact on GDP was double that of any other event since 1980. During other recessions in that time frame the impact on the second home market was a relatively short period of slacking demand, with little downward pressure on prices. Since 2007, unlike previous recessions, there was a virtual standstill in demand and, in most markets, price erosion which was equal, or in some locations greater than, the impact on primary housing values. The market is recovering, but second home prices are recovering more slowly than many primary markets, and the general opinion is that they will take longer to recover in total in all but the most after markets. A second home, after all, is the one real estate asset class that no one needs, but there is still a relatively large number of households who aspire to ownership.

Changes in Household Composition

Moreover, there are longer term demographic trends that will come into play in future years. When the second home market began expanding in the 1970’s household composition and characteristics were very different than they will be for several years into the future. Then the Baby Boomer was just entering their peak earning years and there was a broad based affluent middle class. Now that affluent middle class is declining. Then, household income was growing in real terms versus contracting. Then, households had a single earner, versus the majority now having two incomes. Then, household rent or mortgage debt was close to 20 percent of income versus 30 to 40 percent now.

Thus, the data suggest there is less real disposable income across a broader segment of the market now than existed 20 to 30 years previously. And, even though there has been a relatively modest increase in household income announced in 2015-2016, the first in several years, the majority of new job growth has been in the service sectors and at lower average wages than the professional job category that fuels the market for second homes.

Age Wave and the Population

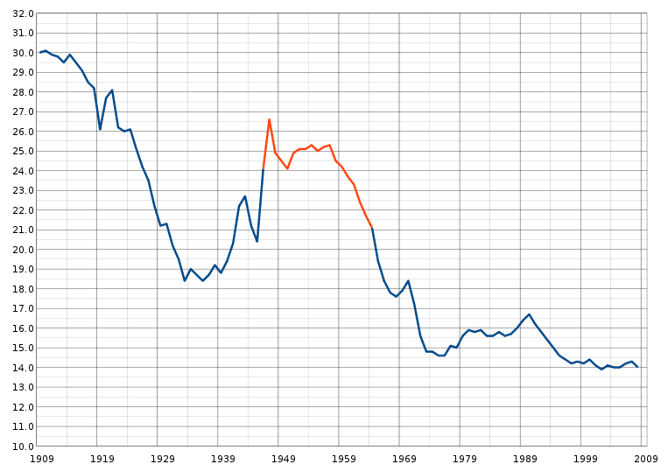

There are additional factors that will impact future second home demand. First, is the age structure of the consumer. As shown in the following graph (Exhibit 1) the annualized birth rate in the United States is at the lowest rate since the early 1900’s, which indicates that the vast majority of the population growth that has occurred has been through immigration. In fact, over 74 percent of the population growth since 1950 has been immigrants and their children. The bulge of the Baby Boom phenomenon is clearly shown in orange, with the resulting rapid decline in births generally defined as Gen X and Gen Y.

Exhibit 1: Annualized Birth Rate Per 1000 Households in the U.S.

Market Size

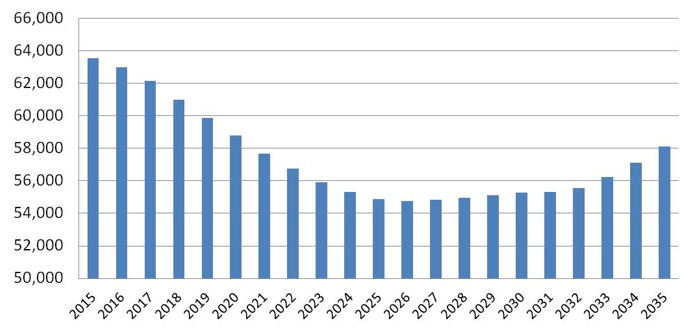

The second factor is the size of the market. The reported buyer profile within the typical second home community is generally between 45 and 65 years old. Based on the age cohorts of the Baby Boom, Gen X, and Gen Y the chart below (Exhibit 2) shows that the number of U.S. residents within the target age bracket (based on birth rates, net of immigration) will be declining annually through 2025.

Exhibit 2: U.S. Native Born Population in the 45-65 Age Cohort by Year (000)

Professional experience also tells us there is typically a five to ten-year window during one's life when there is an aspiration for a second home purchase. There is a belief among many in the research community that as a result of the recession those in the later stages of that cycle may skip the second home purchase decision, focusing instead on a deferred retirement purchase. There is a similar opinion that those in the early stage of that lifecycle have had their confidence in the stability of a second home purchase eroded. Thus, it is reasonable to assume that absorption rates obtained from the mid 1990's to the mid 2000's may be difficult to replicate until the millennial generation reaches the age bracket historically representative of second home consumers.

Concentration of Wealth

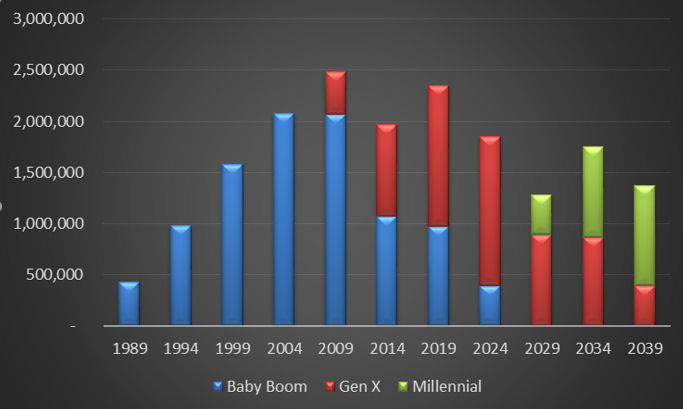

There is a third and equally compelling longer term trend that may impact future demand for second homes, and that is the increasing disparity in income and the erosion of the middle class. The implication is that demand for second homes, as the underlying development costs for land, construction, and the associated amenity base required by consumers will continue to fall increasingly among only the wealthiest of households. Table 3 shows an approximation of the number of income qualified households by age cohort that may be available by year. This table shows the households in each defined generation that represent the top five percent of income. Given that the income to qualify for this subcategory is less than $200,000 per year (but averages @ $325,000 annually) the actual qualified number of households may be significantly smaller than indicated. If a further modification was made to isolate only those with a propensity to purchase the numbers would be smaller still.

Table 3: Age and Income Qualified Households By Generation